4 simple strategies for investing; Things we know and forget

Strategies; The word no matter if you are a trader or a student, a worker or an employee, you have undoubtedly heard it over and over again. However, in the discussion of trading and investment, strategy has a more prominent role; Because your money is at stake, and the wrong decision equals a loss.

Strategies are derived from the word Strategos, which directs to supervising and leading in the wars of archaic Greece. It is no surprise, then, that the term is coined with trade, investment, and planning; Because each of these is like a battleground! You need to know what to do amid a lot of work and information and get there safely. Drawing a plan to achieve the goal is the strategy we follow.

Strategies are not always complicated and bizarre; sometimes, results can be achieved with simple steps and shortcuts that no one expects. You do not need to be trained to pull your kilim out of the water. It is enough to know the basics of the work and gradually improve them.

Four simple strategies

If your head is too busy; So why not prioritize your investment strategies?

In short; Time is of the substance in the digital currency market. You will either learn to decide and act quickly or fall behind. The digital currency market is not like any other market you have ever seen. Things are happening very fast in this market.

To understand this, here are some examples:

- Today a project is rising sharply, and tomorrow when you wake up, you will see that it has reached zero.

- Elon Musk tweets about accepting bitcoin in Tesla. I see my grandmother asking me how to buy bitcoin? Elon tweets again, saying bitcoin is [environmentally] damaging to the environment. My grandmother gives up and closes all her trading positions!

- China bans digital currencies for the 1,000th time. People sell their possessions with the excitement of fear. Then it was discovered that the news was fake and people started shopping again.

- Whales and institutions like JP Morgan or Goldman Sachs manipulate the market; Prices are pumped and dumped.

So if you want to operate in this market, you have to be fully equipped. It is as if you are on a boat in the middle of the ocean, and a storm is blowing around you day and night. You can not sit still, but you do not have much time to think; So you have to decide and act fast.

Number one: Forget the year 2009 and move on.

I have a friend who is very interested in technology news. In 2013, he introduced me to the world of bitcoin. From then on, every time I see him, he tells me:

Bitcoin is very expensive right now; It is too late to enter the market now.

The same old, classic story of “Follow the news every day, never buy.” It’s true for my friend.

Many people these days are indeed obsessed with blockchain technologies and digital currencies; But if you sit in a corner and constantly complain about why you did not buy digital currency ten years ago, you will usually miss a job!

A Chinese proverb says:

The best time to plant a tree was 20 years ago. The next best time is now.

Research the market, find suitable projects. Plan your arrival, and do not doubt your heart.

Number two: Buy and sell at the same time

As a trader or investor, you probably have rules to buy:

- You may spend 10 to 20 percent of your monthly salary on digital currency.

- Buy a coin when it reaches the X price target.

- Implement the Strategies of averaging or buying a step on particular money monthly and weekly basis.

These strategies are excellent and recommended. However, if you are thinking about shopping and do not have clear ideas about your exit strategies, this puzzle is incomplete.

You have probably heard many people recommend buying bitcoins and never selling them. Many of us believe that bitcoin is the gold of the future. We see it more as a valuable asset and hope to count on it in retirement. So bitcoin hoodie we.

This strategy may work for Bitcoin, but this is not a wise strategy for many tokens.

Check out the top 100 currencies from 2013 to 2015 and even 2019. How many names do you know? What percentage of those currencies are still valid? Eighty to 90 percent of these projects have been destroyed, reduced in price, or marginalized.

You have to set a stop loss for altcoins (including the Ethereum). It is best to liquidate or liquidate one or all of your trading positions when prices exceed the set limits. Even if you are not a day trader, these automated alerts and actions will help you invest safely.

Do not be too greedy. If your coins experience a sharp price increase, look for profit. For example, suppose you thousand dollars today Dogecoin for a bought a. After three months, Elon Musk tweets about this Meem Quinn. Thanks to Elon Musk‘s tweet, you now have $ 3,000. At this point, it’s best to cash out $ 1,500 of your assets. That way, you’ve raised your initial investment, made some money, and can remain a member of the Dodge Quinn community (if that’s important).

3- Buy on the floor

Shopping on the floor; reading it is enjoyable, let alone a chance to shop on a biological basis.

Let’s be realistic; Buying digital currencies is very risky when the market is falling or in a downtrend. Often, however, buying in these circumstances becomes the most profitable investment.

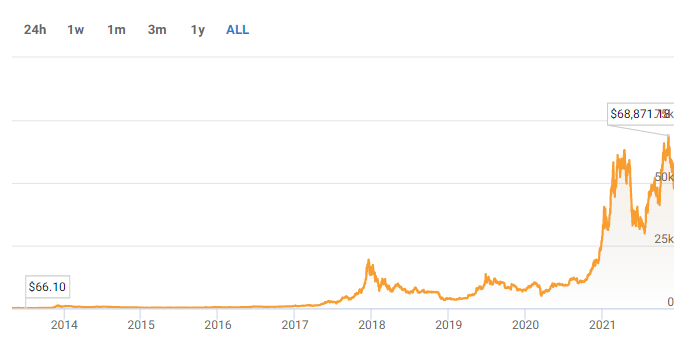

If you look at the historical chart of Bitcoin, you will see that during the life of this digital currency, its price has fallen between 20 and 70%, 6 or 7 times. In 2021, we experienced fear and uncertainty with Elon Mask tweets and Chinese news. In 2020, the Coronavirus outbreak also caused suspicion and mistrust among investors. This process may continue in the same way.

We have learned from price changes in the past that powerful currencies like Bitcoin are always finding their way to a historical high (and beyond). This means that when the market falls by 60 to 70%, you have a chance to buy these currencies at a discount.

In some of these price falls, you do not have unlimited time to decide, and this situation only lasts a few days.

This is not a financial recommendation, But the next time this happens!

4- Please be greedy; But not for the six coins

Make no mistake. Greed and buying on the floor have nothing to do with buying and selling six coins.

If you go to YouTube and type in the search box:

What are the best digital currencies with a 1000% return potential right now?

Then randomly open one of the channels where someone recommends you:

Hurry up and buy Kevin DOGEMOONSWAPODOT!

Then you invest a thousand dollars in this coin. The rest of the story is almost inevitable. You see, your initial capital is slowly running out. It takes so long for your money to go to zero.

If you are not an expert in trading and investing, there is no problem. The technical concepts of Blockchain Technology and digital currencies do not know, OK. It is still OK if you do not have enough time to review each project’s tokens, teams, and essential features.

Blindly following people is not the right way. It is wrong to realize that you have made a mistake or made a bad investment and still insist on following the same path. Be vigilant in such situations!

Have you invested in the wrong token? It’s OK. This is what happens to all of us. Close your trading position with a 20, 30, or 40% loss. This will be a valuable lesson for you in the future. Do not worry. If you learn your homework well, there will always be a better chance of profit.

If you are new to this field, stick to the most robust and most reputable Bitcoin and Ethereum. As you go along, increase your knowledge of other projects and diversify your portfolio.

Concluding remarks

Bitcoin has risen an average of 200 percent in recent years. We hear new news about coins with 10 or 100 times efficiency every day. People get rich overnight and go bankrupt overnight.

News and events also change prices. Remember China, the US Securities and Exchange Commission (SEC), El Salvador, Elon Musk, Corona, etc. Now compare this to the traditional stock market. You probably do not see this level of tension and instability in it.

Looking at the date, it turns out that you can have 10 to 15 percent annual returns in this market—a safe and, at the same time, boring gamble. The digital currency market is moving fast. If you want to be a good player in this game, you have to move fast.

What is certain is that each of us has used many of these issues in our lives and transactions, and we have probably suffered thousands of times because we ignored them. We need to keep in mind that achieving success in the digital currency market requires increasing knowledge, learning from mistakes, reviewing programs over and over again, and following these simple principles.